☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table |

207 High Point Drive, Suite 300

Victor, New York 14564

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

BROADSTONE NET LEASE, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statements, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ | No fee |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table |

207 High Point Drive, Suite 300

Victor, New York 14564

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

April 9, 2021

Dear Fellow Stockholder of Broadstone Net Lease, Inc.:

You are cordially invited to attend the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Broadstone Net Lease, Inc. (the “Company”). The meeting will be held on Thursday, May 20, 2021, at 3:00 p.m., Eastern Time. Consistent with last year’s meeting, the Annual Meeting will be conducted as a “virtual meeting” of stockholders. Regardless of whether you plan to attend the Annual Meeting, we encourage you to vote in advance by internet, phone, or mail. It is helpful for us to receive as many votes as possible in advance, so that we can be assured of having a quorum represented. Details regarding the items of business, how to vote in advance of the Annual Meeting, and how to register and attend the Annual Meeting are described in further detail later in this proxy statement.

As previously announced, Amy L. Tait, our Chairman and one of our founders, will be retiring from the Board of Directors at the conclusion of the Annual Meeting. The employees of Broadstone Net Lease, Inc. and the Board of Directors are immensely grateful to Amy for all that she has contributed to the Company over the years. We are a better organization because of her wisdom, entrepreneurial spirit, and endless dedication to serving the Company and its investors over the past 15 years. We all wish Amy the best as she embarks on a new set of adventures.

Following the Annual Meeting, Amy will pass the baton to Laurie A. Hawkes, who will begin serving as the Chairman of the Board of Directors at the conclusion of the Annual Meeting. Laurie has been a Director since 2016 and most recently served as the Company’s Lead Independent Director. Laurie has held a variety of leadership positions in numerous real estate and financial services over the course of her career and has two decades of prior net lease real estate experience from her time at U.S. Realty Advisors, LLC, including serving as U.S. Realty Advisors’ President from 2003 through 2007. Having Laurie as Chairman ensures a smooth transition of leadership and we are excited to continue along our journey with her as our Chairman.

Finally, we are pleased to announce that we have two new nominees for our Board of Directors. The Company’s Nominating and Corporate Governance Committee has been working hard to recruit new talent, leading to the nomination of Denise Brooks-Williams and Michael A. Coke to serve on the Board of Directors. Denise currently serves as the Senior Vice President and CEO, North Market, for Henry Ford Health System, Inc., a leading not-for-profit health care and medical services provider, and Mike currently serves as the President of Terreno Realty Corp., a publicly traded REIT with a focus on multi-tenant industrial assets. Both are highly skilled executives, with professional and life experiences that will enhance and complement the existing skill sets and perspectives of our other directors. Additional information regarding Denise and Mike is included in this proxy statement.

Your feedback is important to us and we encourage you to attend the Annual Meeting and to vote for the proposals set forth in this proxy statement.

Sincerely,

|

| |

|

| |

|

|

800 Clinton Square

Rochester, New York 14604

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

Date and Time: | Thursday, May | |

Place: | Online at www.proxydocs.com/BNL | |

Items of Business: |

| |

Record Date: | Stockholders as of the close of business on | |

Proxy Voting: | ||

| Youcan authorize a proxy to vote your | |

Internet |

| By visiting www.proxydocs.com/BNL |

Phone |

| By calling 1-866-390-5372 |

|

|

|

|

| By signing and returning your proxy card if you |

For shares held through a broker, bank or other nominee, you may vote by submitting voting instructions to your broker, bank, or other nominee. Regardless of whether you expect to attend the meeting, please vote your shares ahead of time by authorizing a proxy to vote your shares in one of the ways outlined above. If, after providing voting instructions, you later decide to change your vote, you may do so by (i) delivering a written statement to the Secretary of the Company stating that the proxy is revoked, which must be received prior to the Annual Meeting; (ii) submitting a subsequent proxy with a later date (provided such proxy is received prior to the Annual Meeting); or (iii) attending the Annual Meeting virtually and voting electronically during the Annual Meeting. Your subsequent proxy authorization will supersede any proxy authorization you previously made.

By Order of the Board of Directors of Broadstone Net Lease, Inc., | |

| |

John D. | |

| |

|

Our Annual Report for the fiscal year ended December 31, | |

We are pleased to comply with rules adopted by the Securities and Exchange Commission that allow companies to distribute their proxy materials over the Internet. On or about April 9, 2021,March 22, 2024, we mailed or otherwise made available to our stockholders a Notice of Internet Availability containing instructions on how to access our proxy materials, including our proxy statementProxy Statement and Annual Report for the fiscal year ended December 31, 2020.2023. The Notice of Internet Availability also includes instructions to access your form of proxy to vote via the Internet.

Internet distribution of our proxy materials is designed to ensure faster receipt of such materials by our stockholders, lower the cost of the Annual Meeting and is more environmentally friendly than mailing materials. If you would prefer to receive paper proxy materials, please follow the instructions included in the Notice of Internet Availability.

TABLE OF CONTENTS

Table of Contents

| |

| |

| |

PROPOSAL NO. |

|

| |

| |

| |

| |

207 High Point Drive, Suite 300

800 Clinton Square

Rochester,Victor, New York 1460414564

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY |

We are providing you with this proxy statement,Proxy Statement, which contains information about the items to be voted upon at the 20212024 Annual Meeting of Stockholders (the “Annual Meeting”). Our principal executive offices are located at 800 Clinton Square, Rochester,207 High Point Drive, Suite 300, Victor, New York 14604.14564. The words “we,” “us,” “our,” or “Company,” refer to Broadstone Net Lease, Inc.

When and where is the Annual Meeting?

The Annual Meeting will be held on Thursday, May 20, 2021,2, 2024, at 3;1:00 p.m., Eastern Time. The Annual Meeting will be a completely “virtual meeting” of stockholders. You may attend the Annual Meeting virtually, and vote your shares electronically, by visiting www.proxydocs.com/BNL. In order to attend, you must register in advance at www.proxydocs.com/BNL prior to the deadline of Monday, May 17, 2021 April 29, 2024at 5:00 p.m., Eastern Time. Upon completing your registration, you will receive further instructions via emaile-mail that you must follow to attend the Annual Meeting.

What is this document and why did I receive it?

We have made the proxy statementProxy Statement and the proxy card available to you via the Internet or, upon your request, have delivered printed copies of these materials to you by mail. This proxy statementProxy Statement is being furnished to you as a stockholder of Broadstone Net Lease, Inc. because our Board of Directors is soliciting your proxy to vote at the Annual Meeting. This proxy statementProxy Statement contains information that stockholders should consider before voting on the proposals to be presented at the Annual Meeting.

Why did I receive a Notice of Internet Availability instead of a full set of proxy materials? materials?

We have elected to provide access to our proxy materials on the Internet in accordance with rules adopted by the Securities and Exchange Commission.Commission (the “SEC”). Accordingly, on or about April 9, 2021,March 22, 2024, we mailed or otherwise made available to our stockholders of record at the close of business on March 29, 20211, 2024 (the “Record Date”) a Notice of Internet Availability. The Notice of Internet Availability contains instructioninstructions on how to access our proxy materials, including our proxy statementProxy Statement and Annual Report for the fiscal year ended December 31, 2020.2023. The Notice of Internet Availability also includes instructions to access your form of proxy to vote via the Internet.

Internet distribution of our proxy materials is designed to ensure faster receipt of such materials by our stockholders, lower the cost of the Annual Meeting, and is more environmentally friendly than mailing materials. If you would prefer to receive paper proxy materials, please follow the instructions included in the Notice of Internet Availability.

| 1 | 2024 Proxy Statement |

What is a Proxy?

A proxy is a person who votes the shares of stock of another person who is not able to attend a meeting. The term “proxy” also refers to the proxy card or other method of appointing a proxy. When you submit your proxy, you are appointing the designated officers of the Company as your proxy and you are giving them authority to vote your shares of the Company's common stock, $0.00025 par value per share (the “Common Stock”) at the Annual Meeting. The appointed proxies will vote your shares of common stockCommon Stock as you instruct unless you submit your proxy without instructions. If you submit your proxy without instructions, the

|

|

|

proxies will vote in accordance with the recommendation of our Board of Directors with respect to any proposals to be voted upon or, in the absence of such a recommendation, in their discretion. If you do not submit your proxy, the proxies will not vote your shares of common stock.Common Stock. Therefore, it is important for you to return the proxy card to us (or submit your proxy via telephone or electronically) as soon as possible, regardless of whether you plan on attending the meeting.

What is the purpose of the Annual Meeting?

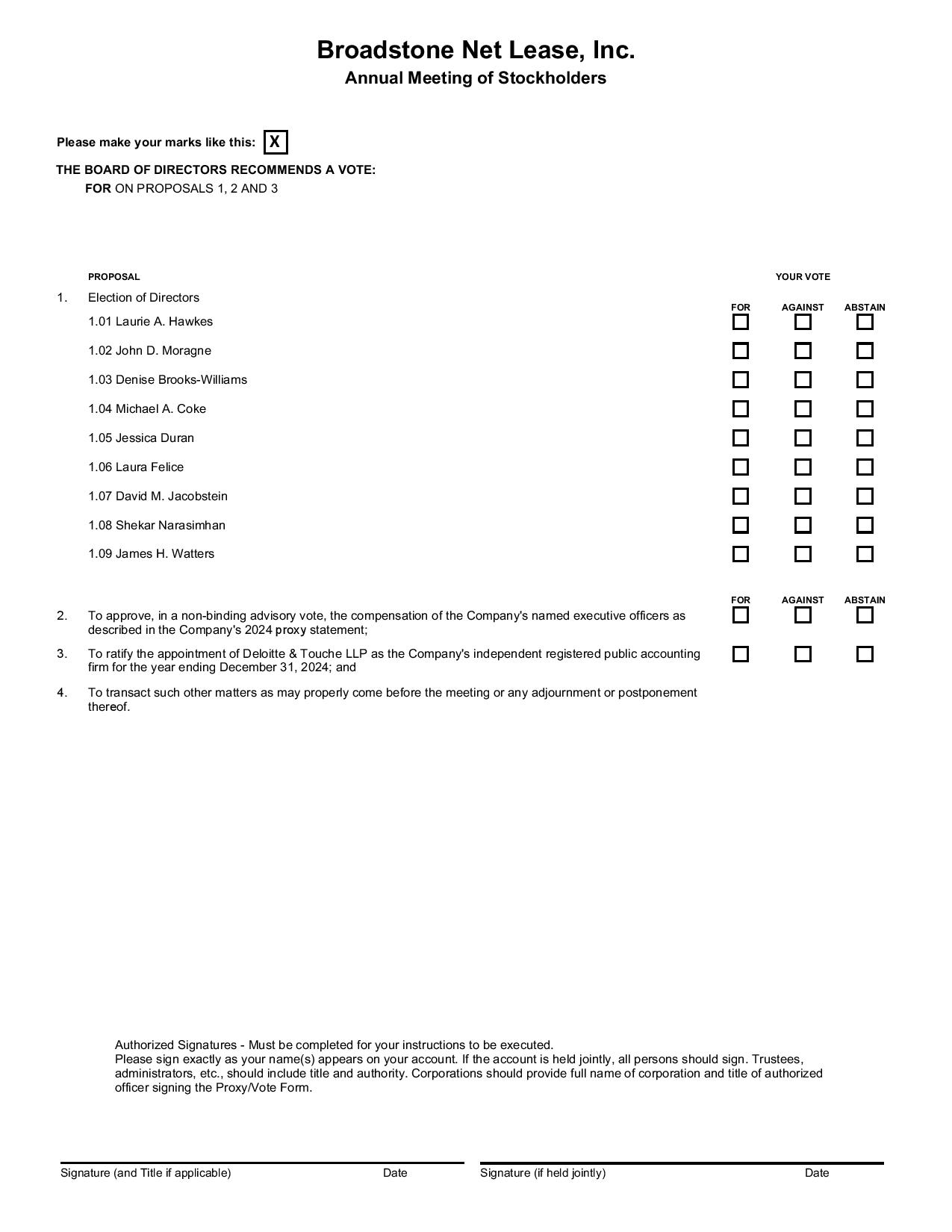

At the Annual Meeting, stockholders will vote upon the following twofour proposals:

| Members of our management team will be available during the Annual Meeting to |

|

|

Our management will also provide attendees with a brief presentation and respond to questions from our stockholders. In addition, representatives of Deloitte & Touche LLP, our independent registered public accounting firm, are expected to be available during the Annual Meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to questions from our stockholders.

How is this solicitation being made and who will bear the costs of soliciting votes?

Solicitation of proxies will be primarily by mail. Our directors, officers, and employees, none of whom will receive additional compensation for their services, may also solicit proxies by telephone, in person, or by e-mail. We have hired Donnelley Financial Solutions (“Donnelley”) and Mediant Inc. (“Mediant”) to assist us in the distribution of our proxy materials.

All the expenses of preparing, assembling, printing, and mailing the materials used in the solicitation of proxies will be borne by us, and we will pay Donnelley and Mediant customary fees and expenses for these services. We do not anticipate any expenses attributed to the solicitation of proxies at this time.

Will my vote make a difference?

Yes! Your vote is needed to ensure that the proposals can be acted upon. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder proxies. We encourage you to participate in the governance of our Company.

Who is entitled to vote?

Holders of record of our shares of common stock, $0.00025 par value per share (the “Common Stock”),Common Stock as of the close of business on March 29, 2021 (the “Record Date”),the Record Date are entitled to receive notice of the Annual Meeting and to vote at the Annual Meeting, or any postponements or adjournments of the Annual Meeting. As of the Record Date, there were 145,811,805188,372,754 shares of our Common Stock issued and outstanding and entitled to vote at the Annual Meeting. Each such outstanding share of Common Stock entitles its holder to cast one vote on each proposal to be voted on during the Annual Meeting.

| 2 | 2024 Proxy Statement |

What constitutes a quorum?

A quorum of stockholders is required for stockholders to take action at the Annual Meeting, except that the Annual Meeting may be adjourned if less than a quorum is present. The presence, either in person or by proxy, of at least a majority of the shares of Common Stock entitled to be cast at the Annual Meeting on any matter will constitute a quorum. If a quorum is not present at the Annual Meeting, or if a quorum is present but sufficient votes to approve a proposal are not received, the chairman of the Annual Meeting may adjourn the Annual Meeting from time to time to a date not more than 120 days from the original Record Date to permit further solicitation of proxies.

How is quorum determined?

For the purpose of determining whether a quorum is present at the Annual Meeting, shares that are voted “For,” “Against,” “Abstain”, or “Withhold”,“Abstain,” as applicable, will be treated as being present at the Annual Meeting. Accordingly, if you have returned a valid proxy or attend the Annual Meeting, your shares will be counted for the purpose of determining whether there is a quorum, even if you wish to abstain from voting on some or all matters.

|

|

|

Broker non-votes (defined below) will also be counted as present for purposes of determining the presence of a quorum. A “broker non-vote” occurs when a broker does not vote on a matter on the proxy card because the broker does not have discretionary voting power for that particular matter and has not received voting instructions from the beneficial owner.

How Many Votes Are Required to Approve Each Proposal?

Election of Directors. You may vote “FOR”, “AGAINST” or “WITHHOLD” for each director nominee. Pursuant to the Company’s Second Amended and Restated Bylaws (“Bylaws”), in an uncontested election, a majority of votes cast at the Annual Meeting is required to elect each Director. “Majority of votes cast” means that the number of shares voted “FOR” a Director’s election exceeds 50% of the total number of votes cast with respect to that Director’s election, with votes “cast” including all votes “FOR”, “AGAINST” and “WITHHOLD.” There is no cumulative voting in the election of Directors. For purposes of the election of Directors, abstentions and other shares not voted (whether by broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum. The officer holding the proxies solicited in connection with this Annual Meeting will vote the shares as designated on the proxy, or if no such designation is made, in favor of the election of the nominees.

Ratification of Auditors. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2021. The ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2021, requires the affirmative vote of at least a majority of all votes cast at the Annual Meeting or by proxy. For purposes of the vote on the ratification of Deloitte & Touche LLP, any shares not voted (whether by abstention, broker non-vote, or otherwise) will not be counted as a votes cast and will have no impact on the result of the vote, although abstentions will count toward the presence of a quorum.

How do I vote?

If you are a registered stockholder as of the Record Date, you may vote electronically by attending the Annual Meeting and following instructions to vote. Additionally, you may use any of the following options for authorizing a proxy to vote your shares prior to the Annual Meeting:

|

|

|

|

|

|

|

|

If you authorize a proxy by telephone or Internet, you are not required to mail your proxy card. See the attached proxy card for additional instructions on how to vote.

All proxies that are properly executed and received by us prior to the Annual Meeting, and are not revoked, will be voted at the Annual Meeting in accordance with the instructions on those proxies. If no instructions are specified on a properly executed proxy, it will be voted “FOR” the election of each of the Director nominees set forth in Proposal No. 1 of this proxy statement and “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm as set forth in Proposal No. 2 of this proxy statement.

Even if you plan to attend the Annual Meeting, we urge you to submit a proxy via the Internet, or by telephone or mail, to ensure the representation of your shares at the Annual Meeting.

What happens if I submit my proxy without providing voting instructions on all proposals?

If no instructions are specified on a properly executed proxy, it will be voted as follows:

How do I vote if I hold my shares in “street name”?

If your shares are held by your bank or broker as your nominee (that is, in “street name”), you are considered the beneficial owner of your shares, but your bank or broker areis considered the record owner. You should receive a proxy or voting instruction form from the institution that holds your shares. Follow the instructions included on that form regarding how to instruct your broker to vote your shares.

| 3 |

|

How does the Board of Directors recommend that I vote?

Unless you give other instructions on your proxy card, the individuals named on the card as proxy holders will vote in accordance with the recommendation of our Board of Directors. Our Board of Directors recommends that you vote your shares as follows:

FOR the election of each of the nominees to our Board of Directors; and

FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2021.

Can I change or revoke my vote?

Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. You may revoke your proxy by: (i) delivering a written statement to the Secretary of the Company stating that the proxy is revoked, which must be received prior to the Annual Meeting; (ii) submitting a subsequent proxy with a later date (provided such proxy is received prior to the Annual Meeting); or (iii) attending the Annual Meeting virtually and voting electronically during the Annual Meeting.

If we receive your proxy authorization by telephone or over the Internet, we will use procedures reasonably designed to authenticate your identity, to allow you to authorize the voting of your shares in accordance with your instructions and to confirm that your instructions have been properly recorded. To revoke a proxy previously submitted by Internet, telephone or mail, you may simply authorize a proxy again at a later date using the procedures set forth above, but before the deadline for Internet, telephone or mail voting, in which case the later submitted proxy will be recorded and the earlier proxy revoked.

If your shares are held by your broker or bank as a nominee or agent, you will need to contact the institution that holds your shares and follow its instructions for revoking a proxy.

What happens if an incumbent nominee for our Board of Directors does not receive the affirmative vote of a majority of the votes cast at the Annual Meeting?

Pursuant to our Bylaws, if an incumbent nominee to Board of Directors does not receive the affirmative vote of a majority of the votes cast at the Annual Meeting and therefore is not re-elected, such incumbent Director will promptly tender his or her resignation to the Board of Directors for consideration. The Nominating and Corporate Governance Committee will recommend to the Board of Directors whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors will act on the tendered resignation within ninety (90) days following certification of the stockholder vote and will promptly disclose its decision and rationale as to whether to accept the resignation (or the reasons for rejecting the resignation, if applicable) in a press release, filing with the SEC or by other public announcement, including a posting on the Company’s web site. If any Director’s tendered resignation is not accepted by the Board of Directors, such Director will continue to serve until the next annual meeting of stockholders and until his or her successor is elected and qualified or his or her earlier death, retirement, resignation, or removal. If any Director’s tendered resignation is accepted by the Board of Directors, the Board of Directors may fill the resulting vacancy or decrease the size of the Board of Directors pursuant to the Bylaws.

What happens if stockholders do not ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm?

The stockholder vote on the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 is not binding on the Company. If the stockholders do not ratify the appointment, the Audit Committee will reconsider the appointment. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

What happens if additional proposals are presented at the Annual Meeting?

Other than the matters described in this proxy statement,Proxy Statement, we do not expect any additional matters to be presented for a vote at the Annual Meeting. If other matters are presented and you are voting by proxy, your proxy

|

|

|

grants the individuals named as proxy holders the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

Where can I find the voting results of the Annual Meeting?

We intend to announce preliminary voting results at the Annual Meeting and then disclose the final results in a Current Report on Form 8-K filed with the SEC within four business days after the date of the Annual Meeting. If final voting results are not known when such Form 8-K is filed, they will be announced in an amendment to such Form 8-K within four business days after the final results become known.

How can I get additional copies of this proxy statementProxy Statement and additional information?

We file annual, quarterly, and current reports, proxy statements, and other information with the SEC. You may obtain additional copies of this proxy statementProxy Statement and all other documents filed by us with the SEC free of charge from our website at http:https://investors.bnl.broadstone.com, or by calling our Investor Relations team at 585-287-6500.

Our website address is provided for your information and convenience. Our website is not incorporated into this proxy statementProxy Statement and should not be considered part of this proxy statement.Proxy Statement. Additionally, you may read and copy any reports, statements or other information we file with the SEC free of charge on the website maintained by the SEC at http://www.sec.gov.

|

|

|

Financial Highlights

During fiscal 2023, we:

(1) FFO, Core FFO, AFFO, Net Debt, and GovernanceAnnualized Adjusted EBITDAre are performance measures that are not calculated in accordance with accounting principles generally accepted in the United States of America (“ESG”GAAP”)

Corporate responsibility, including environmental, social,. We present these non-GAAP measures as we believe certain investors and governance (“ESG”) efforts, has been oneother users of our cornerstones sincefinancial information use them as part of their evaluation of our inception.historical operating performance. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the year ended December 31, 2023 under the heading “Non-GAAP Measures,” which includes discussion of the definition, purpose, and use of these non-GAAP measures as well as a reconciliation of each to the most comparable GAAP measure.

| 5 | 2024 Proxy Statement |

CORPORATE RESPONSIBILITY |

We are committed to being a responsible corporate citizen by conducting our operations in a sustainable and ethical manner. We strive to foster a culture that is inclusive, collaborative, and based on trust, and invest heavily in the health and well-being of our employees. We also strive to conduct our operations in an environmentally responsible way and with a governance structure that requires the highest ethical standards. We believe thatthese commitments benefit both the Company and society and are consistent with our corporate responsibility and ESG initiatives are key to our performance and we are focusedfocus on efforts and changes designed to have long-term positive impactsimpact and value for our stockholders, employees, tenants, other stakeholders,partners, and the communities wherein which we live, work, and owninvest.

We have an internal Sustainability Committee that manages our properties. We are committed tosustainability initiatives. Our Sustainability Committee is currently comprised of our ESG efforts not just because we believe it is the right thing to do but also because it is good for our business.

Environmental

As a real estate owner, we are awareChief Executive Officer, Chief Financial Officer, Chief Operating Officer, SVP and General Counsel (Chair), and SVP, Human Resources and Administration. The Board, through its Nominating and Corporate Governance Committee (the “Governance Committee”), has direct oversight of the need to developCompany's sustainability initiatives, with discussions regarding sustainability matters and implement environmentally sustainable practices within our businessinitiatives held between management and are committed to doing so. We believe that mitigating environmental risks and working to implement sustainable practices is important to the success and long-term performance of our business.

Our efforts in this area are primarily undertaken in partnership with our tenants due to the nature of our business model. We acquire, own, and manage primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. Substantially all of our portfolio is subject to net leases, which generally means that, among other things, our tenants are responsible for maintenanceeach of the buildingsGovernance Committee and properties as well as implementation of any sustainable business practices or environmental initiatives. As a result, when and where possible, we are focused on working with our tenants to promote environmental responsibility and energy efficient facilities. For example, we recently partnered with a tenant on a project to install over 2,000 solar modules on the roof of the tenant’s facility, which were estimated to result in an 18% reduction in electric power needs and a reduction of 17,900 tons of CO2 emissions over the system’s lifetime.

In addition to exploring partnerships after we have invested in a property, our acquisition process generally includes a robust environmental assessment of every property we acquire, including obtaining a Phase I environmental site assessment based on current industry standards and best practices. We carefully review any recognized environmental conditions identified as a result of the assessment and work with the tenant and nationally recognized environmental experts to implement our go-forward strategy, including any required governmental reporting or remediation action. Our insurance team also carefully evaluates each property in our portfolio to ensure we have appropriate insurance coverage in place, either directly or through the tenant pursuant to the terms of our leases, in an effort to provide the financial resources to address any unforeseen environmental issue, natural disaster, or other risk based on industry best practices.

In addition, we have established our “Go Green” Committee, which promotes environmental mindfulness and spearheads our internal initiatives to encourage sustainability at our corporate offices. Recent initiatives and efforts have included reduced paper consumption through electronic document review and digital signature software, electronic equipment recycling drives, energy conservation programs implemented in consultation with the landlords for our corporate offices, and providing employees reusable drink containers and purified water dispensers that can be used in lieu of single-use plastic water and drink bottles.

Social

Our commitment to our employees is central to our ability to continue to deliver strong performance and financial results for our stockholders and other stakeholders. We are as passionate about our people as we are about real estate. We seek to create and cultivate an engaging work environment for our employees, which allows us to attract, retain, and develop top talent to manage our business. To do that, we believe it is essential that we develop and maintain a culture that lives up to our values of respect, integrity, partnership, humility, gratitude, and fun. We are committed to providing our employees with an environment that is free from discrimination and harassment, that respects and honors their differences and unique life experiences, and that enables every employee to have the opportunity to develop and excel in their role and reach their full potential. We believe that we have created a collaborative, creative workplace where people with unique talents can flourish, where their opinions are valued, and where their contributions are rewarded.

|

|

|

As part of our commitment to our employees, we are focused on the following:

Diversity, Equity and Inclusion – We are committed to providing equal opportunity in all aspects of employment and cultivating a diverse and inclusive workplace. We believe that diverse backgrounds and experiences help drive our performance and are important assets for our company. Our Diversity, Equity, and Inclusion (“DE&I”) committee spearheads our ongoing efforts to deepen our commitment to this important initiative and drive our training, employee engagement, and policy reviews. Given its importance, our efforts to promote greater diversity, equity, and inclusion in our workplace has been instituted as a regular reporting item for our Board of Directors.

Career Development – We strive to create an engaging work experience that allows for career development and related opportunities. We offer numerous opportunities for our employees to engage in personal and professional development, including educational support and financial assistance, participating in industry conferences and networking events, individual leadership and management training, lunch and learn meetings with our CEO and senior team, group trainings (e.g., underwriting, real estate fundamentals, cyber security, ethics, harassment, computer skills), mentorship opportunities, and reimbursement for continuing education requirements.

Employee Wellness – Our employees are our most valuable asset and their individual and group contributions drive our performance and success. AsDirectors on at least a result, we are focused on and invest in our team’s overall health, wellness, and engagement. We employ numerous strategies and initiatives to nurture and nourish our employees’ physical, mental, and emotional well-being, including, among other things, competitive employee benefits, generous fringe benefits to make our office environment more comfortable, transparent and open communication and dialogue between our senior executives and our employee base, events and opportunities for social connectedness, particularly during periods where we are working from home, family-friendly corporate events, routine fitness exploration classes, flu shots administered by a third-party health-services provider, yoga and massage sessions, flexible work schedules to meet specific employee needs, and access to an employee assistance program and other emotional and mental health resources.

Community Engagement – Giving back to our communities is important to us and our employees. We provide regular volunteer opportunities and fundraising initiatives throughout the year that provide our employees with meaningful civic involvement. Since our inception, we have provided opportunities for our employees to contribute time and resources to benefit local nonprofit organizations. Our community engagement efforts are led by our employees through a dedicated committee that is responsible for planning and organizing for our employees our various volunteer opportunities, civic involvement with non-profit organizations, and corporate donations.

Governancequarterly basis.

Corporate Governance Highlights

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance structure include the following:

ourOur Board of Directors is not classified, with eachclassified. Each of our directors is subject to election annually, and we may not elect to be subject to the elective provision of the Maryland General Corporation Law (“MGCL”) that would classify our Board of Directors without the affirmative votestockholder approval.

stockholders have the ability to amend our bylaws by majority vote;

fiveMarch 1, 2024, eight out of eightnine of our directors in fiscal 2020 were independent. Assuming all director nominees are elected at the Annual Meeting, this numberthe ratio of our independent directors will increase to seven outremain the same for 2024.

weOur standing committees are fully independent. We have a fully independent Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee.

|

|

|

at least oneis comprised of our directors qualifies as an “audit committeeindividuals with significant financial expert” as defined by the SEC. Currently, eachexpertise. Each of the members of the Audit Committee of the Board of Directors qualifies as an “audit committee financial expert” as defined by the SEC;

we

| 6 | 2024 Proxy Statement |

weWe do not have a “Poison Pill.” We do not have a stockholder rights plan, and we will not adopt a stockholder rights plan in the future without (a) the approval of our stockholders, or (b) seeking ratification from our stockholders within 12 months of adoption of the plan if the Board of Directors determines, in the exercise of its duties under applicable law, that it is in our best interest to adopt a rights plan without the delay of seeking prior stockholder approval.

Environmental Stewardship

As owners of commercial real estate, we recognize the need for responsible and sustainable environmental policies and practices. To that end, we seek to minimize our overall impact on the environment within the context of our business and encourage environmentally responsible behavior among our employees, vendors, and other business relationships.

We are an industrial-focused, diversified net lease real estate investment trust that invests in primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants. Pursuant to the terms of our leases, our tenants are solely responsible for operating their businesses, including having day-to-day control of each property. As a result, our tenants control their energy usage and have the ultimate say of when and how to implement environmentally responsible practices at our properties. While we do not control our tenant businesses, we recognize that the operation of commercial real estate assets can have a meaningful impact on the environment and believe that we can contribute to the implementation of environmentally responsible and sustainable practices by being conscious of and seeking to address environmental impacts within our control and supporting our tenants to do the same. Our efforts include:

| 7 | 2024 Proxy Statement |

Social Responsibility

Our commitment to our employees is central to our ability to continue to deliver strong performance and financial results for our stockholders and other stakeholders. We seek to create and cultivate an engaging work environment for our employees, which allows us to attract, retain, and develop top talent to manage our business. We also encourage our employees to be actively involved in the communities in which they live through various initiatives.

As part of our commitment to our employees and our community members, as well as supporting and giving back to those in need, we have focused on the following programs:

As discussed above, we believe the successDecember 31, 2023, four of our ESG initiatives, includingnine directors identify as female and 56% of our DE&I initiatives, willdirectors identify with underrepresented groups. Further, as of December 31, 2023, employees who identify as female comprise 58% of our workforce, 35% of our officers, and 30% of our Senior Leadership Team, and approximately 14% of our employees have long-term positive impacts on the Company,self-reported as well asHispanic or Latino, Black or African American, Asian, or Two or More Races.

| 8 | 2024 Proxy Statement |

| 9 | 2024 Proxy Statement |

CORPORATE GOVERNANCE |

Board Structure

We operate under the direction of our Board of Directors, which is responsible for the management and control of our affairs. Our Board of Directors currently consists of nine members.members and will be comprised of nine members upon the conclusion of the Annual Meeting. Our Bylaws provide that the number of our directors may be established, increased, or decreased by a majority of our entire Board of Directors from time to time, provided that the number of directors constituting the Board of Directors may never be less than the minimum number required by Maryland law, nor more than twelve.

Each director elected at the Annual Meeting will hold office until the next annual meeting of stockholders and until his or her successor is duly elected and qualified or until his or her earlier death, resignation, or removal. A director may resign at any time by delivering his or her resignation to the Board of Directors, the Chairman of the Board, or the Secretary of the Company. Any vacancies on our Board of Directors for any cause, except an increase in the number of directors, may be filled by a majority of the remaining directors, even if the remaining directors do not constitute a quorum, and a majority of the entire Board of Directors may fill a vacancy that results from an increase in the number of directors. Any director elected to fill a vacancy will serve for the remainder of the full term of the directorship in which the vacancy occurred and until his or her successor is elected and qualified.

At any meeting of the Board of Directors, except as otherwise required by law, a majority of the total number of directors then in office will constitute a quorum for all purposes.

To reduce or eliminate certain potential conflicts of interest in our operations, our Articles of Incorporation requireCharter requires that a majority of our directors be Independent Directors,"Independent Directors" (as defined by our Charter), as discussed in detail below. While our governance documents do not require the separation of the offices of Chairman of the Board and Chief Executive Officer, our Company and Board of Directors currently operatesoperate under a leadership structure with separate roles for our Chairman of the Board and our Chief Executive Officer. Pursuant to this structure, our Chairman presides over meetings of, and matters before, the Board of Directors, and our Chief Executive Officer is responsible for the general management of our business, financial affairs, and day-to-day operations. The Board of Directors believes that this allocation of responsibilities strikes an effective balance between efficient operational leadership and strong independent oversight, and is currently the most appropriate leadership structure for the Company.

|

|

|

Additionally, whenif our Chairman is not an independent director, the Board of Directors may appoint a Lead Independent Director to complement the leadership of the Chairman and the Chief Executive Officer. Key responsibilities of ourthe Lead Independent Director would include, among others, facilitating communications between the Independent Directors and the Chairman of the Board, the Chief Executive Officer, and other members of management, and, if our Board of Directors determines that our Chairman is conflicted with respect to a particular matter, presiding over meetings and discussions regarding such matter. Our Chairman and Lead Independent Director are each nominated by the Nominating and Corporate Governance Committee and each serve for an annual term beginning at the Board of Directors meeting following the annual meeting of stockholders at which such directors are elected.

During the 2020 fiscal year, our Board of Directors was led by our Our current Chairman, and founder, Amy Tait. On January 11, 2021, we announced Ms. Tait’s decision not to stand for re-election and the appointment of Ms.Laurie A. Hawkes, as Chairman, effective as of the conclusion of the Annual Meeting. With the appointment of anis independent Chairman,so we will not have a Lead Independent Director for the upcoming term.

Oversight of Risk Management by the Board of Directors and Its Standing Committees

One of the key functions of our Board of Directors is informed oversight of our risk management process. Our Board of Directors administers this oversight function directly, with support from its four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, and the Real Estate Investment Committee, each of which addresses risks specific to its respective areas of oversight. In particular, as more fully described below, our Audit Committee is responsible for considering and discussing our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Our Nominating and Corporate Governance committee provides oversight with respect to corporate governance and ethical conduct and monitors the effectiveness of our corporate governance guidelines, including whether such guidelines are successful in preventing illegal or improper liability-creating conduct. Our Real Estate Investment Committee is responsible for approving, or recommending that the full Board approve, transactions in excess of certain thresholds, as well as providing oversight with respect to our investment strategy, criteria, and process.

Our Board of Directors has determined that each of Mmes. Hawkes, Brooks-Williams, Duran, and Brooks-WilliamsFelice and each of Messrs. Coke, Jacobstein, Narasimhan, Rosenberger, and Watters is an “Independent Director” pursuant to our Articles of Incorporation.Charter. In determining that Ms. Denise Brooks-Williams qualified as an independent director,Independent Director, our Board of Directors considered that: (1) Ms. Brooks-Williams is the head of a division of a company with which Broadstone Net Leasethe Company has entered into a lease transaction in the ordinary course of its business; (2) the lease was negotiated on arms’-length length terms, and Ms. Brooks-Williams had no direct or indirect involvement in the lease transaction; (3) Ms. Brooks-Williams was not a member of the Board of Directors at the time the Company entered into the lease; and (3)(4) Ms. Brooks-Williams has no pecuniary interest in the lease. In determining that Ms. Felice qualified as an Independent Director, our

| 10 | 2024 Proxy Statement |

Board of Directors considered that: (1) Ms. Felice is the Chief Financial Officer of BJ’s Wholesale Club Holdings, Inc. (“BJ’s”); (2) BJ’s was previously a tenant of the Company pursuant to a lease that was assumed by the Company in an arms’ length transaction; (3) a termination of such lease was negotiated in fiscal 2021 and became effective in January 2023; (4) Ms. Felice had no direct involvement in the negotiation of the lease terms or termination of the lease; (5) Ms. Felice was not a member of the Board of Directors at the time the Company entered into the lease or the agreement effectuating the termination of such lease; and (6) Ms. Felice had no pecuniary interest in the lease or termination thereof.

Meetings of the Board of Directors

The Board of Directors met sixteenseven times during the year ended December 31, 2020.2023. All of the members of the Board of Directors attended at least 75% of the total number of meetings held by the Board of Directors and each committee of the Board of Directors on which he or she served during his or her period of service. Directors who are unable to attend meetings due to scheduling conflicts receive all materials and are briefed on matters presented to the Board of Directors. We do not have a formal policy requiring directors to attend annual meetings of stockholders, although we do encourage their attendance. All of our directors attended our 20202023 Annual Meeting of Stockholders.

Communicating with the Board of Directors

Our Board of Directors provides a process for stockholdersinterested parties to send communications to them. Any stockholderinterested party who desires to contact members of our Board of Directors may do so by sending written communications addressed to such directors c/o ourdirector(s)s to the Company's Secretary, Broadstone Net Lease, Inc., 800 Clinton Square, Rochester,207 High Point Drive, Suite 300, Victor, NY 14604.14564. We will forward all such communications (other than unsolicited advertising materials) to such member or members of our

|

|

|

Board of Directors, as deemed appropriate by our Secretary based upon the facts and circumstances outlined in the communication received.

Our Board of Directors may establish committees it deems appropriate to address specific areas in more depth than may be possible at a full meeting of our Board of Directors. Our Board of Directors has established an Audit Committee, a Compensation Committee, a Nominating and Corporatea Governance Committee, each of which is comprised entirely of Independent Directors. Upon the invitation and request of a Real Estate Investment Committee. committee Chair, members of management, including our Chief Executive Officer, may attend committee meetings, with such presence being predicated on input on matters of discussion during all or a portion of the relevant meeting. Members of the Audit Committee, Compensation Committee, and Governance Committee, as well as the entire Board of Directors, regularly meet in Executive Session with and without management.

The Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee each operate under a written charter that was approved by the Board of Directors, each of which is available on our website at http:https://investors.bnl.broadstone.com.investors.bnl.broadstone.com.

| 11 | 2024 Proxy Statement |

The following table belowprovides a summary of the selected areas of Board of Directors and committee oversight.

Area of Oversight | Audit | Compensation | Governance | Full Board of Directors |

Board Governance | ● | ● | ||

Compensation Trends and Practices | ● | ● | ||

Corporate Strategy | ● | |||

Diversity, Equity & Inclusion (“DE&I”) Matters | ● | ● | ● | |

Enterprise Risk Management | ● | ● | ||

Sustainability Matters | ● | ● | ● | |

Information Technology and Cybersecurity Matters | ● | ● | ||

Legal and Regulatory Compliance | ● | ● | ● | |

Privacy and Data Security | ● | ● | ||

Tax Matters | ● | ● |

The following table indicates current committee assignments and the number of times each committee met in fiscal 2020.2023. Up to date information regarding committee assignments is available on our website at https://investors.bnl.broadstone.com.

Director | Audit | Compensation | Governance | Real Estate Investment** |

Denise Brooks-Williams |

|

| ● | ● |

Michael A. Coke | Chair |

|

| ● |

Jessica Duran | ● | ● |

|

|

Laura Felice | ● |

| ● |

|

Laurie A. Hawkes |

| ● |

| ● |

David M. Jacobstein | ● | Chair | ● |

|

John D. Moragne |

|

|

|

|

Shekar Narasimhan |

|

| ● | Chair |

Geoffrey H. Rosenberger* | ● |

| ● |

|

James H. Watters |

| ● | Chair |

|

Number of meetings in Fiscal 2023 | 4 | 9 | 4 | 1 |

* Mr. Rosenberger retired from the Board of Directors, effective at the conclusion of the Company’s 2023 Annual Meeting of Stockholders on May 4, 2023.

** The Real Estate Investment Committee was dissolved by the Board of Directors on April 27, 2023.

Director | Audit | Compensation | Nominating and Corporate Governance | Real Estate Investment |

Amy L. Tait |

|

|

| ● |

Christopher J. Czarnecki |

|

|

|

|

Laurie A. Hawkes |

| ● |

| ● |

David M. Jacobstein | Chair | Chair | ● |

|

Agha S. Khan |

|

|

| ● |

Shekar Narasimhan |

|

|

| Chair |

Geoffrey H. Rosenberger | ● |

| ● |

|

James H. Watters | ● | ● | Chair |

|

Number of meetings in Fiscal 2020 | 4 | 7 | 3 | 2 |

| 12 | 2024 Proxy Statement |

Audit Committee

The Audit Committee meets on a regular basis, at least quarterly, and more frequently as the chair of the Audit Committee deems necessary. The Audit Committee must at all times be comprised of at least three members, and each member of the Audit Committee must be an Independent Director. The purpose of the Audit Committee is to assist our Board of Directors in fulfilling its duties and responsibilities regarding, in addition to other related matters:

the integrity of our financial statements and other financial information provided by us to our stockholders and others;

the selection of our independent auditors and review of the auditors’ qualifications and independence;

the evaluation of the performance of our independent auditors; and

oversight of the Company’s compliance with legal and regulatory requirements that could have a significant impact on our financial statements;

The Audit Committee is also responsible for engaging, evaluating, compensating, and overseeing an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans for and results of the audit engagement, approving services that may be provided by the independent registered public accounting firm, including audit and non-audit services, such as tax services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees, and reviewing the adequacy of our internal accounting controls. The Audit Committee will also will prepare the audit committee report required by SEC regulations to be included in our annual report.report on Form 10-K.

|

|

|

Our Audit Committee is composed of Messrs. Coke (Chair) and Jacobstein, (Chair), Rosenberger, and Watters.Mmes. Duran and Felice. Our Board of Directors determined affirmatively that each member of our Audit Committee qualifies as an “audit committee financial expert” as such term has been defined by the SEC in Item 407(d)(5) of Regulation S-K and that all members of the Audit Committee meet the SEC’s independence requirements of the SEC and NYSE for audit committee membership. Assuming he is re-elected at the Annual Meeting, Mr. Jacobstein will rotate off the Audit Committee and will no longer be a member, effective upon conclusion of the Annual Meeting.

Compensation Committee

The Compensation Committee meets at least once each year. The Compensation Committee must at all times be comprised of at least three members, and each member of the Compensation Committee must be an Independent Directors.Director. The purpose of the Compensation Committee is to assist our Board of Directors in fulfilling its duties and responsibilities regarding, in addition to other related matters:

discharging responsibilities relating to compensation of the Company’s Chief Executive Officer, other executive officers, and directors, taking into consideration, among other factors, any stockholder vote on compensation;

implementing and administering the Company’s incentive compensation plans and equity-based plans;

overseeing and assisting the Company in preparing the Compensation Discussion & Analysis for inclusion in the Company’s proxy statementProxy Statement and/or annual report on Form 10-K;

providing for inclusion in the Company’s proxy statementProxy Statement a description of the processes and procedures for the consideration and determination of executive officer and director compensation; and

preparing and submitting for inclusion in the Company’s proxy statementProxy Statement and/or annual report on Form 10-K a Compensation Committee Report in accordance with applicable rules and regulations.

The Compensation Committee has the authority, in its sole discretion, to retain or obtain the advice of a compensation consultant, legal counsel, or other adviser as it deems appropriate. The Compensation Committee may form and delegate authority to subcommittees consisting of one or more members when it deems appropriate. Our Compensation Committee is composed of Messrs. Jacobstein (Chair) and Watters, and Ms. Hawkes.Mmes. Hawkes and Duran. Our Board of Directors determined that each member of our Compensation Committee meets the definition

| 13 | 2024 Proxy Statement |

of a “non-employee trustee”director” for the purpose of serving on our Compensation Committee under Rule 16b-3 of the Securities Exchange Act.Act of 1934, as amended (the “Exchange Act”), as well as the independence requirements of the NYSE for compensation committee membership.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (the “Governance Committee”) must at all times be comprised of at least two members, and each member of the Governance Committee must be an Independent Director. The purpose of the Governance Committee is to assist our Board of Directors in fulfilling its duties and responsibilities regarding, in addition to other related matters:

identifying and recommending to the full Board of Directors qualified candidates for election as directors and recommendrecommending nominees for election as directors at the annual meeting of stockholders consistent with criteria approved by the Board of Directors;

developing and recommending to the Board of Directors a set of corporate governance guidelines applicable to the Company, and implementing and monitoring such guidelines as adopted by the Board of Directors;

overseeing the Board’sBoard of Directors' compliance with financial, legal, and regulatory requirements and its ethics program as set forth in the Company’s Code of Ethics;

reviewing and making recommendations to the Board of Directors on matters involving the general operation of the Board of Directors, including the size and composition of the Board of Directors and the structure and composition of its committees;

recommending to the Board of Directors nominees and chairs for each committee of the Board committee;

annually facilitating the assessment of the Board of Director’s performance as a whole and of individual directors, as required by applicable law and regulations;

overseeing the Board of Director’sDirectors' evaluation of management; and

identifying, reviewing, and advising the Board of Directors and management regarding current and emerging trends, issues, practices, and initiatives with respect to environmental stewardship, social responsibility, and corporate governance; and

|

|

|

Our Governance Committee is comprised of Messrs. Watters (Chair), Jacobstein, and Rosenberger.Narasimhan and Mmes. Brooks-Williams and Felice. Our Board of Directors determined that each member of our Governance Committee meets the independence requirements of the NYSE for nominating and corporate governance committee membership.

Real Estate Investment Committee

Our Board of Directors established a Real Estate Investment Committee in 2020 after the completion of our management internalization transactions. Until April 27, 2023, when the Real Estate Investment Committee was dissolved by the Board of Directors, the Real Estate Investment Committee was responsible for approving, or recommending that the full Board of Directors approve, transactions in excess of certain thresholds; providing oversight with respect to our investment strategy, criteria, and process; providing assistance and support to management and the Board of Directors in the review and approval of transactions; and reviewing with management on a periodic basis the performance and valuation of properties previously approved for acquisition.

The Real Estate Investment Committee held one meeting in 2023. Until it was dissolved on April 27, 2023, our Real Estate Investment Committee was comprised of Messrs. Narasimhan (Chair) and Coke, and Mmes. Hawkes and Brooks-Williams. The Board of Directors is responsible for all matters that were previously delegated to the Real Estate Investment Committee.

| 14 | 2024 Proxy Statement |

Oversight of Risk Management by the Board of Directors and Its Standing Committees

One of the key functions of our Board of Directors is informed oversight of our risk management process. Our Board of Directors administers this oversight function directly, with support from its three standing committees: the Audit Committee, the Compensation Committee, and the Governance Committee, each of which addresses risks specific to its respective areas of oversight. Additionally, our Audit Committee is responsible for considering and discussing our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements and oversight of the performance of our internal audit function. Finally, the Audit Committee oversees the Company’s enterprise risk management processes, including risks related to information technology and cybersecurity matters. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Our Governance Committee provides oversight with respect to corporate governance and ethical conduct and monitors the effectiveness of the Corporate Governance Guidelines, including whether the Corporate Governance Guidelines are successful in preventing illegal or improper liability-creating conduct.

Information Technology and Cybersecurity

See “Item 1C. Cybersecurity” of our Annual Report on Form 10-K for the year ended December 31, 2023 for a summary of the policies and practices developed and implemented by management and the Board of Directors with respect to the risk assessment and risk mitigation of information technology and cybersecurity matters.

Identification of Director Nominees

The Governance Committee may identify potential candidates for our Board of Directors from other members of the Board of Directors, executive officers, and other contacts. Further, the Governance Committee may engage the services of an independent third-party search firm to assist it in identifying and evaluating potential director candidates who will bring to the Board of Directors specific skill sets as established by the Governance Committee. While we do not have any minimum qualifications with respect to director nominees, the Governance Committee considers many factors in connection with each candidate, including but not limited to the candidate’s character, wisdom, judgment, ability to make independent analytical inquiries, business experiences, understanding of our business environment, acumen, and ability to devote the time and effort necessary to fulfill his or her responsibilities, all in the context of the perceived needs of our Board of Directors at that time. While individual diversity as well as diversity in experience and areas of expertise are factors that are considered by the Governance Committee in its assessment of candidates, neither the Board of Directors nor the Governance Committee has adopted any specific diversity-driven criteria or composition requirements. Our Board of Directors seeks individuals having knowledge and experience in finance and accounting, corporate governance, risk management, and senior leadership. The Governance Committee also considers factors such as experience in the Company’s industry and experience as a board member of another corporation. The Board of Directors also seeks individuals who bring unique and varied perspectives and life experiences to the Board of Directors. As such, the Governance Committee assists the Board of Directors by selecting or recommending candidates who it believes will enhance the overall diversity of the Board of Directors.

The Governance Committee does not have a policy with regard to the consideration of any director candidates recommended by stockholders. The Governance Committee believes that such a policy is not necessary because the members of our Board of Directors have access to a sufficient number of excellentqualified candidates from which to select a nominee if and when a vacancy occurs on the Board of Directors. However, the Governance Committee will consider stockholder recommendations for candidates for our Board of Directors. Nominations by stockholders must be provided in a timely manner and must include sufficient biographical information so that the Governance Committee can appropriately assess the proposed nominee’s background and qualifications. For a stockholder to have his or her candidate considered by the Governance Committee for inclusion as a director nominee at the 20222025 annual meeting of stockholders, stockholder submissions of candidates for nomination to the Board of Directors must be received in writing at our offices by the Company’s Secretary, 800 Clinton Square, Rochester,207 High Point Drive, Suite 300, Victor, New York 1460414564 no earlier than November 10, 2021October 23, 2024 and no later than 5:00 p.m., Eastern Time, on December 10, 2021;November 22, 2024; provided, however, that in the event that the date of the 20222025 annual meeting of stockholders is advanced or delayed by more than thirty days from the first anniversary of the date of the Annual Meeting, written notice of a stockholder

| 15 | 2024 Proxy Statement |

proposal must be delivered not earlier than the 150th day prior to the date of the 20222025 annual meeting of stockholders and not later than 5:00 p.m., Eastern Time, on the later of the 120th120th day prior to the date of the 20222025 annual meeting of stockholders or the tenth day following the day on which public announcement of the date of the 20222025 annual meeting of stockholders is first made. Potential nominees recommended by a stockholder in accordance with these procedures will be considered and evaluated in the same manner as other potential nominees.

Real Estate Investment Committee

Our Board of Directors established a Real Estate Investment Committee in 2020 after the completion of our management internalization transactions. The Real Estate Investment Committee is responsible for approving, or recommending that the full Board of Directors approve, transactions in excess of certain thresholds; providing oversight with respect to our investment strategy, criteria, and process; providing assistance and support to management and the Board of Directors in the review and approval of transactions; and reviewing with management on a periodic basis the performance and valuation of properties previously approved for acquisition.

Our Real Estate Investment Committee is comprised of Messrs. Narasimhan (Chair) and Khan and Ms. Hawkes.

Director Orientation and Continuing Education

We provide each director who joins our Board of Directors with an initial orientation about our Company, including our business operations, strategy, policies, and governance. We also provide all of our directors with resources and ongoing education opportunities to assist them in staying educated and informed with respect toof real

|

|

|

estate markets, developments in corporate governance, and critical issues relating to the operation of boards of public companies and their committees.

Director Stock Ownership Policy

Pursuant to our current director compensation and stock ownership policy, each of our non-employee directors isare required to acquire and retain ownership of a minimum of $250,000 in shares of our Common Stock. AllStock (excluding unvested shares of ourrestricted stock) valued at five (5) times their annual cash retainer (not including any additional retainers for leadership or committee membership) within five years of joining the Board of Directors. Non-employee directors currently meet this requirement.must retain at least 50% of any stock awards received from the Company until the minimum share ownership level is met. Shares of our Common Stock owned indirectly by a non-employee director (e.g., through a spouse) count towards meeting this stock ownership requirement. New directors have four years to comply with this requirement.

Code of Ethics and Business Conduct Policy, Corporate Governance Guidelines, and Anti-Bribery and Anti-Corruption Policy

We have adopted aOur directors, officers, and employees are required to comply with our Code of Ethics, our Corporate Governance Guidelines, and our Anti-Bribery and Anti-Corruption Policy, each of which is available on our website at http:https://investors.bnl.broadstone.com. Among other matters, our Code of Ethics is designed to deter wrongdoing and to promote:

honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

full, fair, accurate, timely, and understandable disclosure in reports and documents that the Company files with, or submits to, the SEC and in offering documents, stockholder reports and other public communications made by the Company;

compliance with applicable laws and governmental rules and regulations;

the prompt internal reporting of violations of the Code of Ethics to an appropriate person or persons identified in the Code of Ethics; and

accountability for adherence to the Code of Ethics.

investors.bnl.broadstone.com. Any waiver of the Code of Ethics for our directors or executive officers must be approved by the Board of Directors or the Audit Committee, and any such waiver shall be promptly disclosed as required by law and NYSE regulations. Our employees have access to members of our Board of Directors to report anonymously, if desired, any suspicion of misconduct by any member of our senior management or executive team.the Company. Anonymous reporting is always available through the Company’s whistleblower hotline and reported to our Audit Committee quarterly.

Corporate Governance Guidelines

Our Board of Directors adopted the Guidelines to assist in understanding and effectively implementing its functions, evidencing the Company’s ongoing commitment to high standards of corporate conduct and compliance. The Guidelines provide a framework for the Company’s system of corporate governance and address specific issues pertaining to the Company’s governance, including the composition of the Board of Directors, director compensation, management compensation and performance evaluations, and commitment to diversity and inclusion.

Policy Prohibiting Hedging and Pledging of Company Stock

Under the Company’s Insider Trading Policy, no employee of the Company nor member of the Board of Directors may engage in any hedging transaction that would result in a lack of exposure to the full risks of ownership. Prohibited hedging transactions include, but are not limited to, collars, forward sale contracts, trading in publicly-traded options, puts, calls, or other derivative instruments related to Company stock or debt. In addition, except for the Board’sBoard of Directors' ability to waive the restrictions in limited circumstances, no employee of the Company, nor member of the Board of Directors may hold Company securities in a margin account, pledge Company securities as collateral for a loan or “short” sell Company securities.

|

|

|

Our Articles of IncorporationCharter and Bylaws provide that the number of our directors may be established, increased, or decreased by a majority of our entire Board of Directors from time to time, provided that the number of directors constituting our Board of Directors may never be less than the minimum number required by law in Maryland, our state of incorporation, or more than twelve. Our Board of Directors is currently comprised of eightnine directors, fiveeight of whom are independent directors,Independent Directors.

Directors Skills, Qualifications and Attributes

The matrix below illustrates the diverse set of skills, knowledge, experiences, backgrounds, and personal attributes represented on our Board of Directors.

| Brooks-Williams | Coke | Duran | Felice | Hawkes | Jacobstein | Moragne | Narasimhan | Watters |

Knowledge, Skills and Experience | |||||||||

Executive Leadership | | | | | |

| | | |

Financial and Accounting Expertise | | | | | | |

| | |

Human Capital Development | |

|

|

| |

| |

| |

IT and Cybersecurity |

|

| |

|

|

| |

| |

Legal, Compliance and Regulatory |

|

| | | | | |

|

|

Other Public Company Boards |

| |

|

| | |

|

|

|

Public and Private Capital Markets Expertise |

| |

| | | | | | |

Real Estate | | |

|

| | | | | |

Strategic Development and Planning | | | | | | | | | |

Demographics | |||||||||

Race/Ethnicity | |||||||||

American Indian or Alaska Native |

|

|

|

|

|

|

|

|

|

Asian |

|

|

|

|

|

|

| |

|

Black or African American | |

|

|

|

|

|

|

|

|

Caucasian |

| |

| | | | |

| |

Hispanic or Latino |

|

|

|

|

|

|

|

|

|

Native Hawaiian or Other Pacific Islander |

|

|

|

|

|

|

|

|

|

Two or More Races |

|

| |

|

|

|

|

|

|

Gender | |||||||||

Female | |

| | | |

|

|

|

|

Male |

| |

|

|

| | | | |

None of the Above |

|

|

|

|

|

|

|

|

|

Age | |||||||||

Years Old | 56 | 56 | 49 | 42 | 68 | 77 | 41 | 70 | 70 |

Board Tenure | |||||||||

Years | 3 | 3 | 1 | 1 | 7 | 10 | 1 | 16 | 16 |

| 17 | 2024 Proxy Statement |

The Board of Directors and Governance Committee believe that the attributes above, along with the leadership skills, experience and other qualifications below provide the Company with the varying perspectives, skills and judgment necessary to guide the Company’s strategies and oversee their execution.

Required Vote

You may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to the election of each director nominee. Pursuant to the Bylaws, in an uncontested election, a majority of votes cast at the Annual Meeting is required to elect each Director. “Majority of votes cast” means that the number of shares voted “FOR” a Director’s election exceeds 50% of the total number of votes cast with respect to that Director’s election, with votes “cast” including all votes “FOR”, “AGAINST,” and “ABSTAIN.” There is no cumulative voting in the election of Directors. For purposes of the election of Directors, abstentions and other shares not voted (whether by broker non-vote or otherwise) will not be counted as definedvotes cast and will have no effect on the result of the vote, although abstentions and broker non-votes will be considered present for the purpose of determining the presence of a quorum. The officer holding the proxies solicited in connection with this Annual Meeting will vote the shares as designated on the proxy, or if no such designation is made, in favor of the election of the nominees.

Pursuant to our Bylaws, if an incumbent nominee to the Board of Directors does not receive the affirmative vote of a majority of the votes cast at the Annual Meeting and therefore is not re-elected, such incumbent Director will promptly tender his or her resignation to the Board of Directors for consideration. The Governance Committee will recommend to the Board of Directors whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors will act on the tendered resignation within ninety (90) days following certification of the stockholder vote and will promptly disclose its decision and rationale as to whether to accept the resignation (or the reasons for rejecting the resignation, if applicable) in a press release, filing with the SEC or other public announcement, including a posting on the Company’s web site. If any Director’s tendered resignation is not accepted by our Articlesthe Board of Incorporation (“Independent Directors”).Directors, such Director will continue to serve until the next annual meeting of stockholders and until his or her successor is elected and qualified or his or her earlier death, retirement, resignation, or removal. If any Director’s tendered resignation is accepted by the Board of Directors, the Board of Directors may fill the resulting vacancy or decrease the size of the Board of Directors pursuant to the Bylaws.

Board Recommendation

At the Annual Meeting, nine directors are to be elected for the ensuing year and until their successors are elected and qualify. SevenThe Board of Directors has nominated nine individuals for re-election at the Annual Meeting, each to serve for a one-year term that expires at our annual meeting of stockholders in 2025 and until their successors have been elected and qualified. All nine nominees for director, listed below, currently serve as a director of the Company and all of the nominees have consented to be named in this proxy statementProxy Statement and to serve as a director if elected. If any nominee becomes unavailable for any reason, the shares represented by proxies may be voted for a substitute nominee designated by our Board of Directors.

The following individuals have been nominated by thebiographical information highlights each nominee’s specific experience, attributes and skills that has led our Board of Directors to conclude that he or she should continue to serve as directors of the Company until the next annual meeting of stockholders and until their successorsa director. We have been elected and qualified: Laurie A. Hawkes, Christopher J. Czarnecki, Denise Brooks-Williams, Michael A. Coke, David M. Jacobstein, Agha S. Khan, Geoffrey H. Rosenberger, Shekar Narasimhan, and James H. Watters. All nine nominees are listed on the enclosed proxy card.